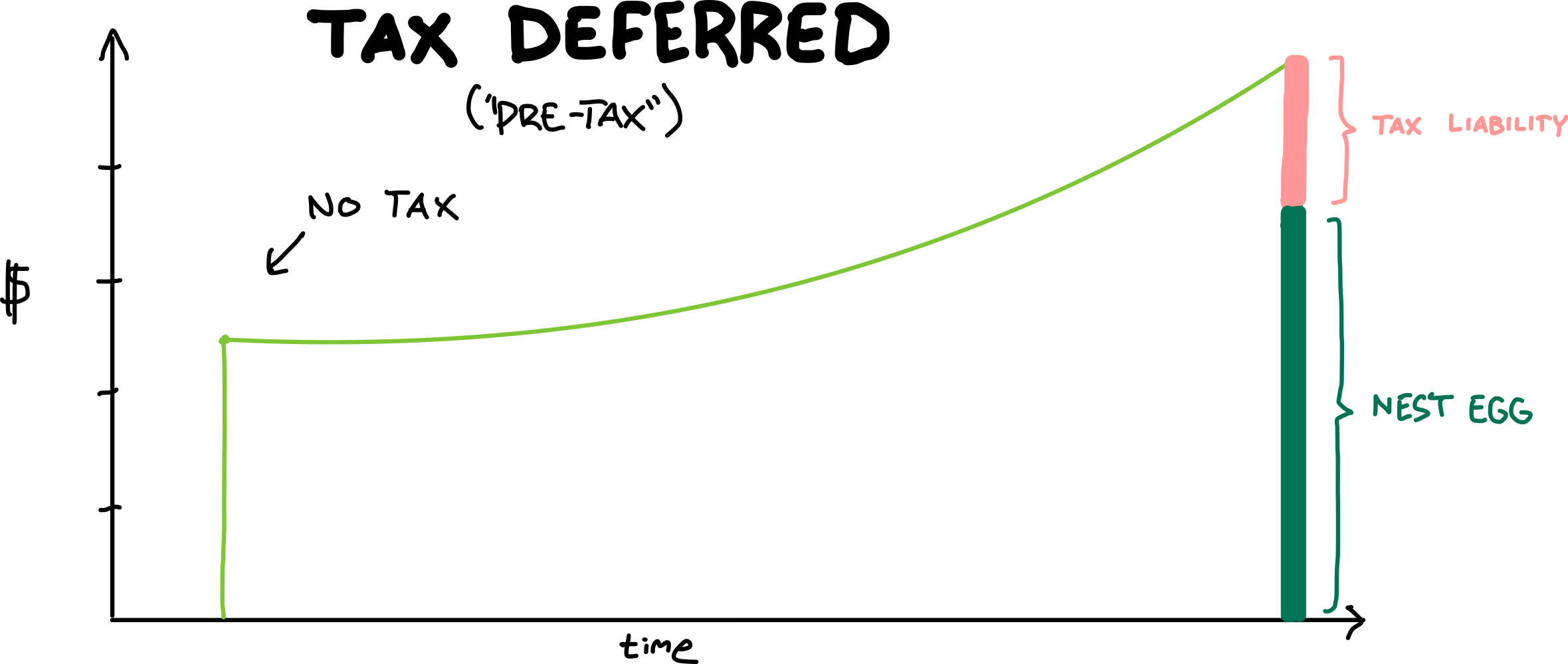

Standard 401k and other accts. No tax now, yes tax later.

Tax-Deferred accounts allow you to not pay income taxes on the money you’re putting into them now, and instead pay taxes on the money when you go to withdraw it from the account.

There are certain restrictions and constraints you have to abide by, or pay penalties (such as personal age requirements or length-of-time requirements).